What Should Home Buyers Think About Before Contacting a Real Estate Agent? April 10th, 2023…

What are Seller Concessions?

What are Seller Concessions?

April 7th, 2023 | Tom Theewis

When purchasing a home there are certain costs that as a buyer you are responsible for. Some of those costs can be covered by the seller with a seller concession. What is a seller concession you might ask? Well, I am here to take you on an epic journey explaining what a seller concession is, what specific costs it can cover, what are the limits for the buyer and seller (yes this one is very important), how and when you can negotiate the concession, and lastly what are the advantages of a seller concession.

First, let’s understand what a seller concession is. A seller concession is an amount of money the seller can contribute to the purchase transaction to cover closing costs that the buyer is responsible for.

When buying a home, you pay closing costs and fees to cover the costs of getting the mortgage. Closing costs usually range from around 1% – 3% of the purchase price of the home.

In some instances, you may be able to get the seller to pay for some or all of these closing costs. These are called seller concessions, and they can be a powerful way to save on your closing costs. Before you close on your mortgage, learn how to use seller concessions below to your advantage.

What Costs Can Seller Concessions Cover?

The seller may be able to cover part of all of the below closing costs:

- Property Taxes: Pre-paid property taxes through the end of the year at closing

- Title Search, Title Report, and Title Insurance Policy: The title search and report check for any outside ownership claims to the property. Lenders’ title insurance (REQUIRED) and owner’s title insurance (OPTIONAL) protect your lender and you against losses in case a claim arises after closing.

- Loan Origination Fees: These origination fees cover your lender’s charges for processing your loan.

- Appraisal Fee: This covers the cost of getting a licensed third-party appraisal of the home to determine the market value of the property.

- Discount Points: Discount points are an upfront fee that you can pay to permanently reduce your interest rate.

*A full list of typical closing costs can be found at the end of this blog.

Are There Limits to Seller Concessions?

Absolutely! First, a seller concession can only cover closing costs and certain temporary buydown options, like a 2-1 Buydown. A seller concession can not cover any part of the down payment.

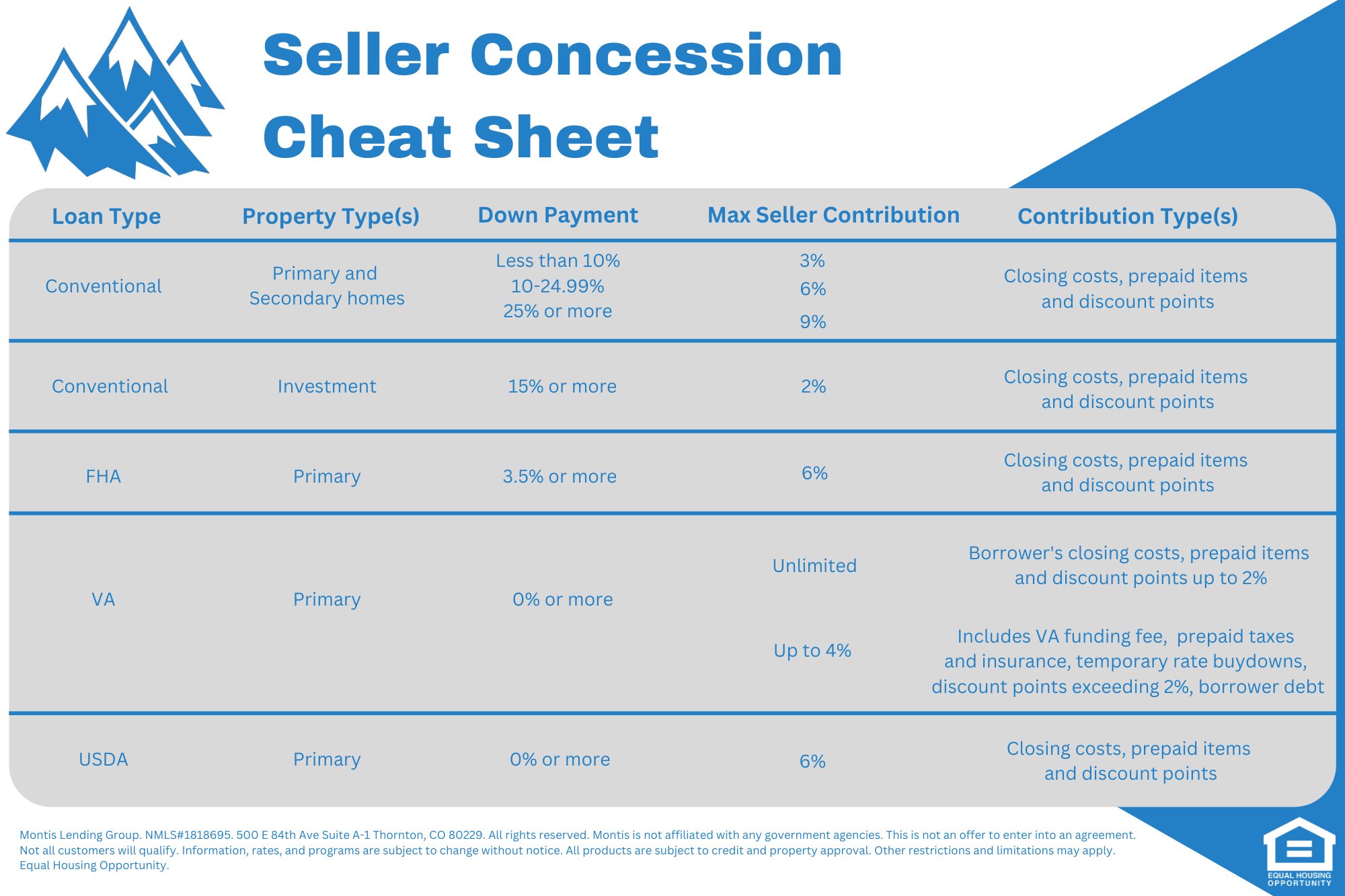

Now that we understand what the seller concession can cover, let’s discuss the limits on how much that concession can be. The limit for the concession is dictated by loan type and down payment amount. I made a handy dandy cheat sheet for your convenience.

When and how do I negotiate seller concessions?

This is where it is really important to have a great mortgage broker (this guy!) and a great real estate agent who can communicate with each other to determine the right amount of seller concessions you can negotiate for. This is done after you get pre-approved but before you submit an offer. The mortgage broker can let your realtor know your estimated closing costs and your concession limit depending on loan type and down payment. Your realtor can advise you how much they think they can get the seller to accept without the seller rejecting the offer.

Who Benefits From Seller Concessions?

The short answer is both the seller and the buyer! For the seller, offering concessions can make their home more attractive to potential buyers. For the buyers, it can help those who don’t have the cash on hand for all their closing costs after their down payment. This helps to get more people into the Real Estate game. Additionally, a lot of first-time home buyers are not aware of the many costs associated with purchasing a home. Therefore, seller concessions are a way to help offset some of those costs making home buying more affordable and attainable.

How to Negotiate Seller Concessions

So you know that you are wanting to ask for concessions, but how do you convince the seller to help you pay for closing costs? Negotiation is key here, understanding, or having a Realtor that understands the current housing market and will go to bat for you.

You’ll need to know, or have a Realtor who is well-versed on if we are in a seller’s or buyer’s market. This will heavily influence your ability to negotiate for concessions. With the interest rates at a high, we are seeing more concessions being offered or agreed upon. Sellers are much more motivated to offer these concessions when their home has been sitting on the market for a while.

The bottom line, the best negotiating power that you have is working with an experienced Real Estate Agent. Additionally, working with a knowledgeable mortgage broker, like Tom Theewis with Montis Lending Group may also increase your negotiating power when talking to the Listing Agent. Your team can research local sales and tell you about your area’s housing market. They can also find similar properties that were sold with concessions. They can present examples of recent sales to help motivate your seller to work with you on closing costs.

Seller Concession Limits by Loan Type

The restrictions on seller concessions vary by loan type. The lesser of the purchase price or the appraised value usually dictates how much your seller can pay in concessions.

For example, let’s say the accepted purchase price of the home is $450,000 but the home appraised at $430,000. For this example, let’s say the seller concessions max out at 3%. The seller can contribute up to 3% of the lesser value, $430,000, or $12,900 to help with closing costs.

Seller Concession Frequently Asked Questions (FAQs)

Can sellers refuse to contribute toward my closing costs?

Sellers do not have to contribute to your closing costs. Any seller concessions must be negotiated into your contract or in an Agreement to Amend/Extend the Contract

Are seller concessions paid out of pocket for the Sellers?

No, seller concessions come out of the seller’s profit for the sale, so they are not directly paid by the seller out of pocket.

Are seller concessions taxable?

Seller concessions are considered to be sales expenses and are tax deductible.

Is it better to ask for seller concessions or a lower sales price?

This truly depends on your situation. If you’re looking to have your closing costs as low as possible, then seller concessions are the best option for you.

The Bottom Line

Seller concessions are closing costs the seller agrees to pay, They can make a home more affordable for the buyer, and they can help the seller close the deal.

The best thing to do is work with your Real Estate Agent to decide whether you have a good opportunity to ask the seller for concessions. If the market is right, and you have a knowledgeable Realtor, you may be able to ask the seller to pay part or all of your closing costs. You and your real estate agent just have to make sure what you’re asking for is within the limits dedicated by the type of loan you qualify for and you’re getting.

Remember, before you can even think about seller concessions, you need to find a property that you love and have your offer accepted. Before you go shopping for your new home, it’s good practice to get pre-approved.

If you’re ready to find your new home, get pre-approved with Montis Lending Group.

To get started on your application click the link below.

https://tomtheewis.floify.com/

List of Typical Closing Costs

- Credit report fee ($35): The cost to pull your credit reports from at least 2 of the top 3 credit bureaus: Experian, TransUnion, and Equifax

- Recording fee ($20-$250): Fees charged by your county to process records when a property changes hands. You’ll likely pay a tax as well, which goes by different names: real estate conveyance, mortgage transfer, documentary stamp, or property transfer

- Survey fee ($400+): In some cases, a professional survey is required to determine property lines. Fortunately, this is not often required

- Attorney fee ($400+): Charged in states where closing attorneys are required. Closing attorneys facilitate closing and negotiating the contract. You can shop for low-cost attorney services

- HOA dues (varies): If you buy in a homeowners association, you’ll probably pay for a copy of the Covenants, Concessions and Restrictions (CC&Rs), a fee for the property manager to complete a condo survey for the lender, and a fee to transfer ownership records

- Closing protection letter (CPL) fee ($50): A fee charged by escrow to create a CPL: a document that puts liability on the title company if the escrow does not disburse the home purchase funds appropriately

- Document prep fee ($50): The fee that the escrow company charges to prepare the final loan documents for signature

- Property tax reserves ($500-$2,500 or more): Most buyers pay 2-6 months of property taxes upfront at closing. Note: This can increase your closing costs significantly because property taxes can cost a few hundred dollars per month

- Homeowners insurance ($400-$1,000 or more): Homeowners typically pay 6-12 months of homeowners insurance premiums upfront at closing. Before you close, you should compare insurance companies to find the lowest-cost homeowners policy for you

- Flood insurance ($300-$1,000 or more): This only applies if your home is in a certified flood zone where flood insurance is required. Standard homeowners insurance policies do NOT cover flooding. This insurance is paid separately

- Prepaid interest: You’ll pay upfront for any interest charges accrued on the days between your closing and your first monthly mortgage payment