What Should Home Buyers Think About Before Contacting a Real Estate Agent? April 10th, 2023…

Loan Level Price Adjustments – LLPAs

March 29th, 2023 | Tom Theewis

Some Big Changes to Mortgage Costs Were Just Announced

At the beginning of this year, the Federal Housing Finance Agency (FHFA) released updates to Fannie Mae’s and Freddie Mac’s (the Enterprises) single-family pricing framework. Meaning, that the fees for a vast majority of new mortgages, including purchases, rate-term refinance, and cash-out refinance loans, in the US have changed. Let’s take a closer look.

What Do We Mean by Fees/Costs?

This refers to Loan Level Price Adjustments (LLPAs) imposed by the Enterprises, the two entities that guarantee a vast majority of new mortgage loans. LLPAs are based on loan features such as your credit score, loan-to-value ratio, occupancy, and your debt-to-income ratio.

What Lenders/Loans Does This Apply to?

Regardless of the lender, this will apply to any loan that is guaranteed by the Enterprises. Note that this is most of the home loans in the US. A few examples of loans that would not be affected would be FHA/VA as well as certain jumbo loans and specialty products. These would be the “non-conforming” loans – they are not impacted by this because they are not backed by the Enterprises. The most common example, for the majority of people, of a non-conforming loan would be a jumbo loan from a retail bank or credit union.

When do These Changes Take Effect?

The updated fees will take effect for deliveries and acquisitions beginning May 1st, 2023. This date was chosen in order to minimize the potential for market disruption. We will see many lenders will begin to implement the changes for loans originated in March/April.

So, in a Nutshell, What’s Changed?

First, let’s take a look at what Sandra L. Thompson, the Director of the FHFA had to say regarding these changes. “These changes to upfront fees will strengthen the safety and soundness of the Enterprises by enhancing their ability to improve their capital position over time. By locking in the upfront fee eliminations announced last October, FHFA is taking another step to ensure that the Enterprises advance their mission of facilitating equitable and sustainable access to homeownership.”

So the first positive change is, the penalty for having a credit score under 680 is now smaller than it was. However, it does still cost more to have a lower score. For example, if you have a score of 659 and are borrowing 75% of the home’s value, you’ll now pay a fee equal to 1.5% of the loan balance. But before these changes, you would have paid an astronomical 2.75% fee. On a hypothetical $400,000 loan, that’s a difference of $5,000 in closing costs.

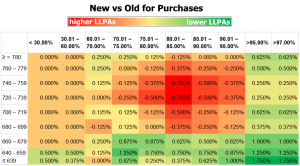

However, elsewhere things got worse. Borrowers with higher credit scores will generally be paying a bit more than they were with the previous LLPA structure. The table below shows where things have gotten better and where things have gotten a bit worse. The fields in green and yellow are a positive change – things have become more affordable. The cells in orange and red show a negative change – more expensive. All values refer to a percentage of the loan amount being changed as an upfront fee.

Remember these fees may not have to come out of your pocket as lenders offer higher interest rates, in some cases, and pay these costs for you. In the form of a lender credit. But the costs are still there, they are still technically being paid by you but in this scenario, it’s being paid over time with the higher interest rate rather than upfront.

Additional Changes

There are other changes that aren’t so easily translated in a table format. The biggest one to note is a new charge for your debt-to-income (DTI) ratio. This change will be a bit controversial considering income calculations can be somewhat subjective and debt calculations can be manipulated with some advance planning. For example, if you’re planning on making a home purchase in 2023 you can start some debt consolidation to avoid paying these fees and lower your total debt. Regardless, every loan guaranteed by the Enterprises has a DTI attached to it. If yours is over 40% and you’re borrowing more than 60% of the home’s value, you’ll be required to pay a fee.

A few other examples of changes that don’t have such a high impact are:

- There are new credit score bands at 760+ and 780+

- There is more differentiation in high-balance vs. non-high-balance ARM loans – this is extremely uncommon as most ARMs are not done through the Enterprises

- A few changes to 2-4 unit property LLPAs

- There’s now a new generic LLPA for “subordinate financing” (for example, a 2nd loan or HELOC). The previous LLPAs were more granular depending on the loan-to-value (LTV) of first-position loans vs. subordinate or second-position loans

- BIG increases in fees for many Cash-out refinance loans

Where Can I Find the Specific Changes?

If you’re curious about the full changes sent out by the FHFA either because you’ll have a loan in process soon or just curious about these changes you can find all the information here: https://singlefamily.fanniemae.com/media/9391/display

Important Note: at the top of that page, there is a link to the previous/existing version of the LLPAs. If you decide to check out the previous version just be sure to note the text at the top of the page to ensure you’re looking at the new LLPAs in reference to your situation for your upcoming home purchase.

You can always reach out to Montis Lending Group for any questions or needing clarification regarding these changes.