What Should Home Buyers Think About Before Contacting a Real Estate Agent? April 10th, 2023…

What is a 2-1 Buydown?

With interest rates still at a high, temporary buydowns have become an avenue that some sellers and buyers may consider. A 2-1 buydown program is a concession offered by sellers to incentivize buyers. A 2-1 buydown essentially allows borrowers to make a lower mortgage payment for the first two years of their loan, and payments go back up on the third year of the loan.

If you’re seeking ways to reduce your monthly mortgage payment before purchasing a home, a 2-1 buydown could be a potential avenue. We’ll explore exactly what a 2-1 buydown is, how it works, and the pros and cons to help you make a decision.

What is a 2-1 Buydown?

A 2-1 buydown program is a type of financing offer to reduce your monthly payments for the first 2 years of your mortgage. In the first year, the monthly payment would be the equivalent of a 2% lower rate. In the second year, the monthly payment would be the equivalent of a 1% lower rate. Starting in the third year until the end of the loan, your payment will be the original interest rate you locked in. The interest rate stays the same for the entire loan, your payment just lowers for the first 2 years.

How does a Temporary Buydown Work?

A temporary buydown is a closing concession available for primary and second home purchases that can only be funded by the seller or the builder if the home is a new build. That concession is then used to offset the monthly mortgage payment for the first 2 years of the loan. The entire concession will be placed in an escrow account with the lender and will be applied to your monthly payment automatically. The difference between the regular payment and the reduced payment comes from this escrow account. Simply put, the seller is paying part of your mortgage payment with a lump sum at closing.

The concession will have to be a part of the purchase contract with the initial offer or it can be added with an amendment to the purchase contract during the loan approval process. The seller concession would have to be at least the amount of the 2 years difference in payments. Any concession left over after the buydown lump sum can still be used for closing costs.

Temporary Buydown Scenario

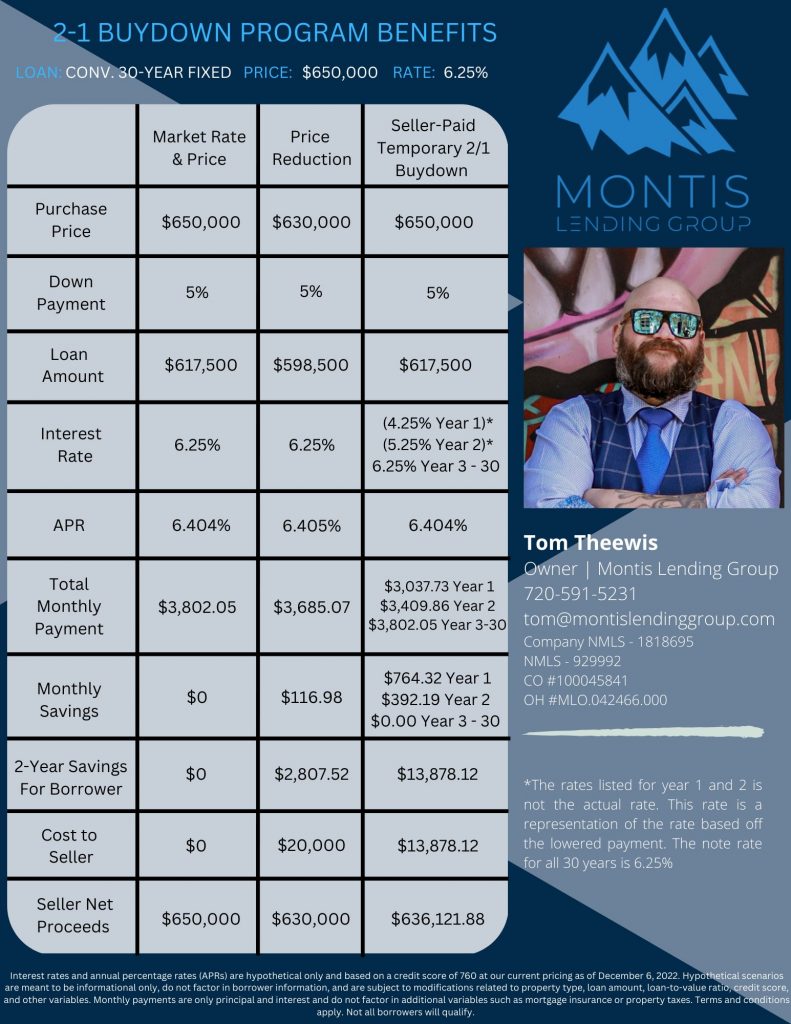

Let’s look at a temporary buydown scenario* to help you understand what it’ll look like in action.

Let’s say you’re buying a $650,000 house with a 5% down payment for a mortgage loan of $617,500 and an interest rate of 6.25% and an APR of 6.404%. A monthly principal and interest (P&I) payment would be about $3,802.05.

With a 2-1 buydown, your interest rate would still be 6.25%, but in year 1 your monthly P&I payment would be $3,037.73. The difference between your normal payment and the payment you would make every month for the first year is $764.32. That $764.32 is paid from the funds that are in the escrow account funded by the seller each month.

In the second year, your interest rate is still 6.25%, but your monthly P&I payment would be $3,409.86. The difference between your normal payment and the payment you would make every month for the first year is $392.19. That $392.19 is paid from the funds that are in the escrow account funded by the seller each month.

Starting the 3rd year until the end of the loan, your P&I payment is back to $3,802.05. The most important part of a 2-1 buy down to understand is that your interest rate does not change, just your payment does. There will be nowhere on the Note that states your interest rate changed or lowered.

Bear in mind that this scenario doesn’t factor in taxes and insurance, so your actual monthly payment amount will vary, but you can see the difference between years 1 and 2 versus years 3 through 30. Running these different scenarios can help you better forecast what you’ll be paying for the first 2 years versus the third year onwards to understand if it’s the right decision for you.

How much does a 2/1 Buydown Cost?

The cost will vary based on the loan amount and interest rate. If we use the same scenario as above, on a $617,500 loan with a 6.25% interest rate, the 2/1 buydown will cost $13,878.12. The actual equation for this is below.

Year 1 – ($3,802.05-$3,037.73) = $764.32 x 12(months) = $9,171.84 Year 2 – ($3,802.05-$3,409.86) = $392.19 x 12(months) = $4,706.28 $9,171.84 + $4,706.28 = $13,878.12(minimum seller’s concession)

If you have any questions please contact Tom Theewis with Montis Lending Group by phone, text or email.

Email: tom@montislendinggroup.com

Call or Text: 720-591-5231

The sample rates provided are for illustration purposes only and are not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. Montis Lending Group, LLC cannot predict where rates will be in the future. The payment example does not include assessments. Actual payment obligations may be greater and may vary. Mortgage Insurance Premium (MIP) is required for all FHA loans and Private Mortgage Insurance (PMI) is required for all conventional loans where the LTV is greater than 80%. Rate(s), APR(s) and payment info is valid as of 12/06/2022 and assumes a first lien position, 740 FICO score, 30-day rate lock, based on a single-family home. All terms are subject to change without notice. Loans are subject to underwriting guidelines and the applicant’s credit profiles, not all applicants will receive approval. Contact Montis Lending Group, LLC for more information.